9 Narratives To Watch In Q3 & Reviewing The Winners of Q2🔮

As Q2 has come to an end, it’s time to evaluate the performance of various sectors including DEX perps, LSDFI, L1/L2 chains and look for upcoming narratives in Q3.

Q2 has been a turbulent period for crypto (yet again). The market peaked around halfway into the quarter, and the following 1.5 months were impacted by a series of bearish news, including lawsuits against large exchanges and fear of USDT & TUSD depegs.

But lots of positive things also transpired in this period, and more importantly, a lot of good things are in store for the upcoming months.👀

Stay up to date with DeFi news and deep-dives that cut straight to the case without putting you to sleep 🧠

Q2 vs Q1 ⚖️

Before diving into upcoming narratives, let’s evaluate which protocols out-performed the past quarter.

There are a few sectors in the DeFi-space that continue to grow and attract organic demand. These include liquid staking, on-chain perpetual exchanges and more.

• Perp DEXs📊

In Q2 this year, on-chain perpetual exchanges like dYdX, GMX, Gains, etc., generated $117m in total fees. These products have maintained high usage throughout the bear market. The ability to trade crypto, forex, and other assets on-chain continues to be one of the areas in DeFi with the most organic demand.

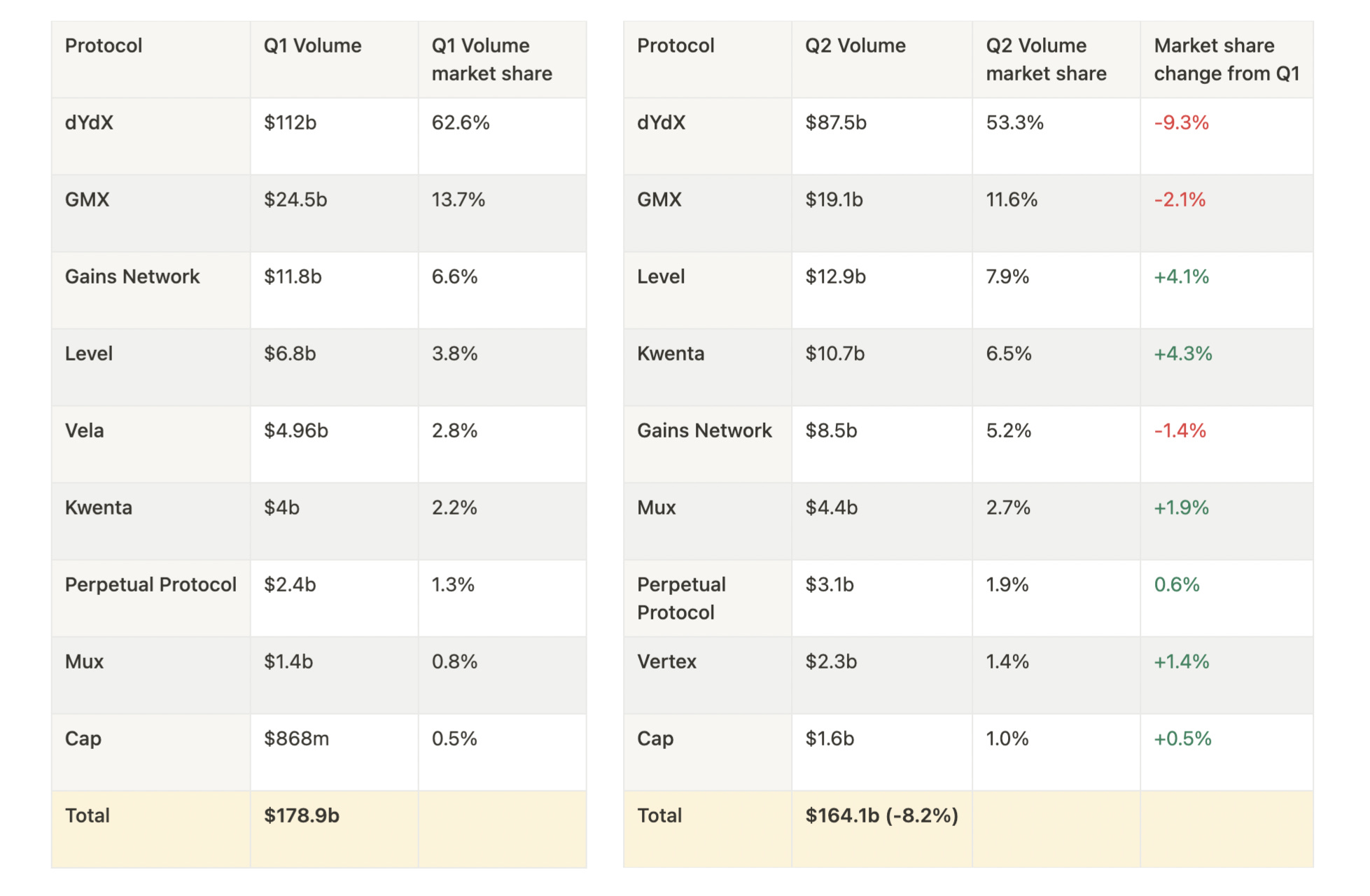

The table below compares the trading volume conducted on the largest perp protocols in Q1 versus Q2.

The total trading volume is down 8.2% compared to Q1, which is not much considering the generally bearish environment we've experienced in Q2. While dYdX continues to lead significantly in terms of trading volume, the protocol has seen a significant decrease in market share quarter over quarter. This is also the case for some of the other 'OG' perps like GMX and Gains.

New protocols like Level and Kwenta have grown a lot, and a major contributor to this growth has no doubt been the large trading rebates (native token emissions) given to traders of the protocols. As these incentives decrease over time, it will be interesting to see whether users stay on the protocol or jump to other trading platforms.

Vertex opened up their Arbitrum native exchange to the public in April and has seen a large increase in trading volume recently. Vertex has not launched their native token yet, so it's likely that some of this volume is generated by airdrop farmers. Worth paying attention to nonetheless!

How are these protocols doing in terms of fees? And how can we create valuations of the native tokens relative to their respective fees, revenue, and earnings?

I provide regular updates on these numbers in my biweekly newsletter. Subscribe to stay up to date with these types of metrics.🧠

Check out last week’s newsletter for the most recent data👇

🀄️DeFi Frameworks Newsletter #001

Thor Hartvigsen • Jun 28, 2023

Welcome to the 1st ever DeFi Frameworks newsletter! I’ve spent the past weeks studying other publications to analyze what’s missing in your inbox. Bullets DeFi Sectors 🗺 News and Catalysts 📰 On-chain Movements 🐳 Level Up Your Knowledge 🧠Every second week I aim to deliver a concise and information-packed newsletter presenting the top i…

Read full story →

• Ethereum Liquid Staking💧

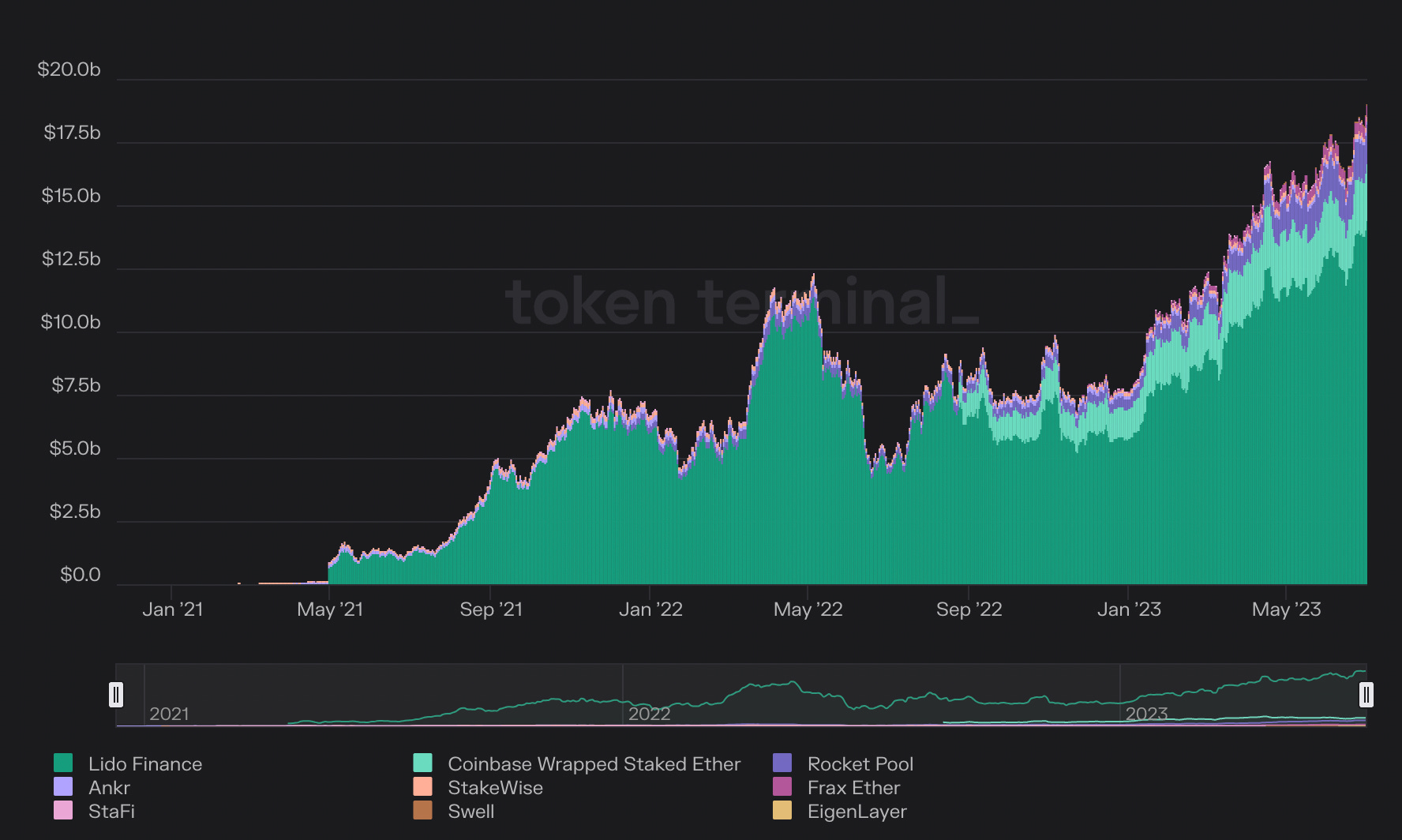

In the past 6 months, liquid staking has increased from ~$7b to over $18b. An inflow of $11b is quite significant when overall DeFi TVL has stayed flat at around $45b.

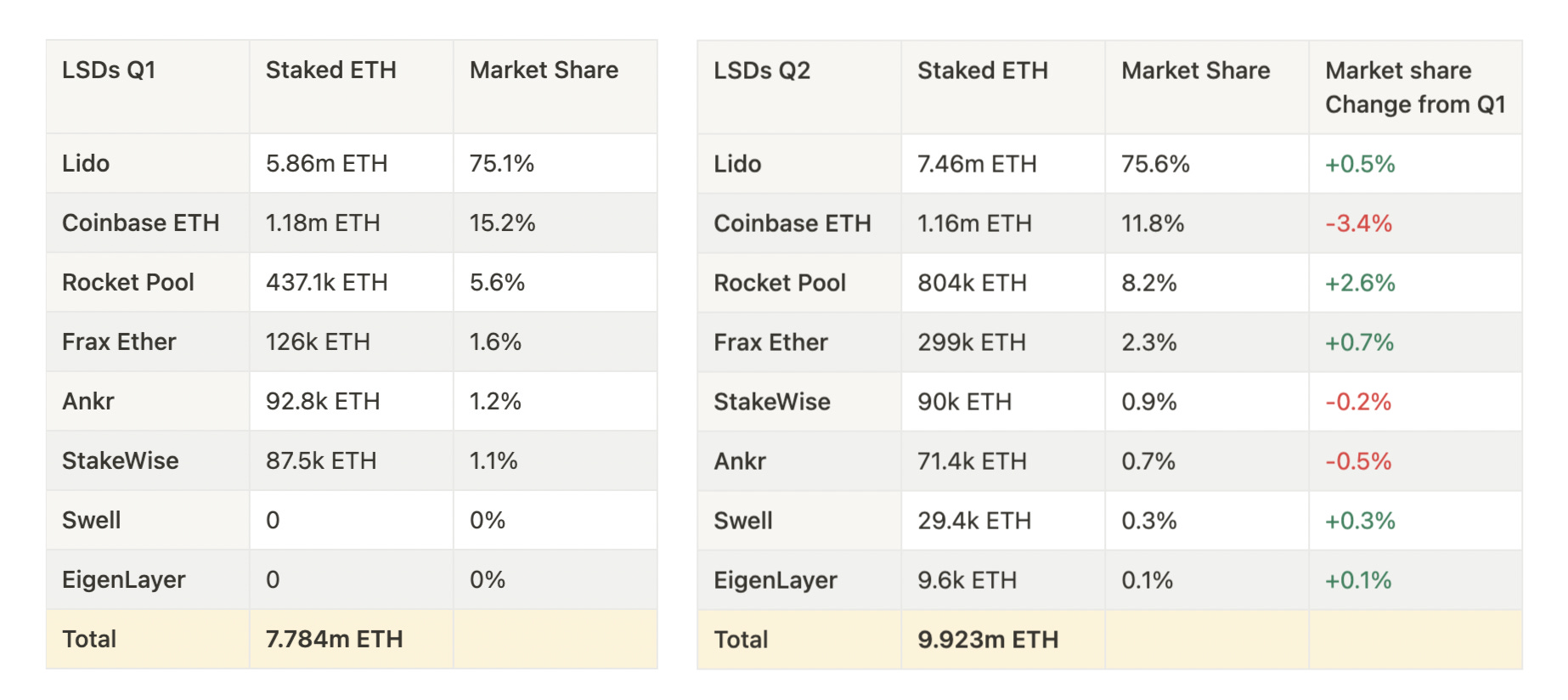

The Shanghai hardfork, which enables unstaking was released earlier this year and played a significant role in the massive inflow of liquidity to this sector. Below is some data comparing Q1 and Q2 in terms of assets staked:

From Q1 to Q2, the big winners are Lido, Rocket Pool, and Frax Finance. Lido has not only seen an inflow of 1.6m ETH ($3b), but the protocol has also gained significant market share despite new competitors emerging.

Both Rocket Pool and Frax have unique moats that have attracted new liquidity. Rocket Pool launched their 8ETH mini-pools, and Frax Ether continues to offer the highest staking yield because of the dual token model. Swell launched in Q2 and has also gained significant TVL (Total Value Locked). They are currently running a campaign where early depositors can farm the upcoming $SWELL token. It's therefore likely that a portion of this new liquidity comes from users wanting to farm the airdrop.

• Chains⛓

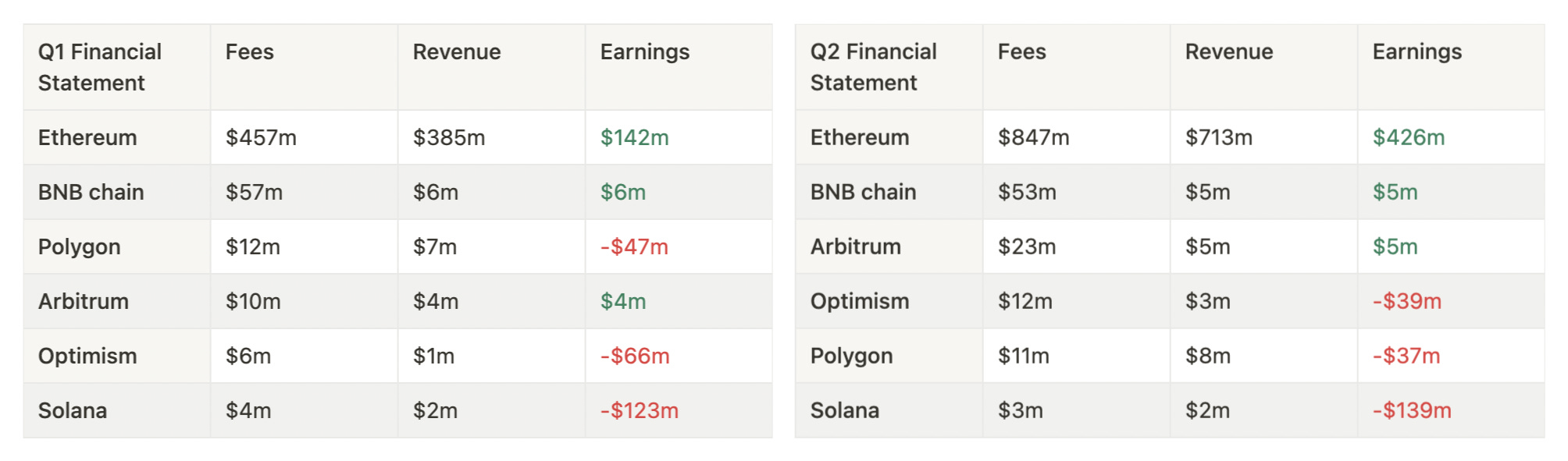

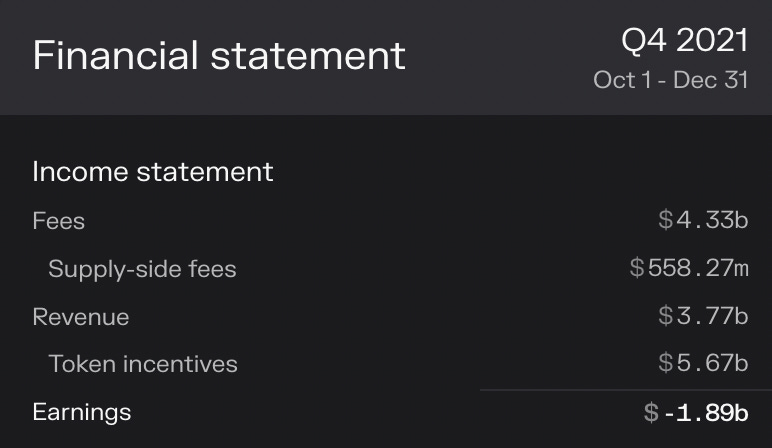

Below are two tables portraying the financial statements of large layer 1 and layer 2 blockchains in the space. The values should be interpreted as following:

- Fees = transaction fees paid by users on the chain

- Revenue = part of the fees that are left after validators receive their share

- Earnings = revenue minus token emissions

Ethereum has had its best quarter ever in terms of earnings, which is up over 300% from Q1 this year. As seen below, in Q4 2021, Ethereum generated $4.3b in fees, but as this was before the switch to proof of stake, a large amount of $ETH was emitted, which caused earnings to be largely negative.

How would these amounts of fees translate to earnings in today's environment? Well, if Ethereum averaged $4b in fees for a whole year with similar profit margins as Q2 2023, the annual earnings would be ~$24b, which leaves ETH at a P/E ratio of no more than 9.5, given the current price of $1900. 🤯

Arbitrum also saw a significant increase in fees generated in this period and is one of the few chains with positive earnings. As of now, the profit margins for layer-2s are quite low, as the majority of fees are paid to mainnet validators. With Proto-Danksharding launching later this year, the profit margin is expected to increase as rollup fees decrease (more on this later).

Chains like Solana, Polygon, and Optimism have large negative earnings due to the large token emissions that are used to incentivize users and pay validators.

9 Catalysts & Narratives to monitor in Q3

Crypto is an attention economy. Protocols with product updates and narratives gather more attention and tend to outperform in the short to mid-term. Below are some of the top narratives worth keeping a close eye on.

1️⃣ Bitcoin ETF🏦

Q2 ended off quite positively for crypto due to the sudden institutional interest in Bitcoin. Blackrock, Fidelity, Invesco, amongst others, have all filed for a BTC ETF, and the general market consensus is that this has a high chance of getting approved. A few days ago, the SEC called the recent filings inadequate, and despite an initial selloff across the market, prices quickly bounced back as these applications seemingly just need some more specifications regarding which exchange they plan on utilizing to offer this product. Many have already been refiled, such as the Fidelity BTC ETF, which names Coinbase as the exchange used.

When could an ETF be approved?

The deadline for the Blackrock and Ark ETF is August 12th and while this can be pushed back, experts predict that an answer is likely at this date.

It seems the market is expecting an approval in August, so both a denial and a delay could put a damper on prices. The final deadline for the Blackrock ETF is February 23rd next year.

The significance of a BTC ETF

Of all the catalysts worth monitoring in the upcoming months, this is by far the most significant. Not only does a Bitcoin ETF grant large institutions access to the asset, but it also sets up the entire crypto market for a bullish period. Altcoins can't rally without proper BTC price movement. DeFi won't see new inflows of liquidity for the same reason. If the ETF gets approved later this year, BTC will be far from the only asset that will benefit. With that in mind, the following catalysts could cause outperformance amongst specific assets in a more bullish environment:

2️⃣ EIP-4844

You likely already know by now that EIP-4844 will introduce Proto-Danksharding to Ethereum, and it's scheduled for Q3/Q4. With this implementation, rollups will be able to send bundled transactions known as blobs to Ethereum mainnet, which will cause fees on these layer-2 chains to be up to 20 times cheaper. The main beneficiary, therefore, won't be Ethereum mainnet, as fees here will not decrease until full Danksharding is rolled out in the future, but rather rollup chains like Arbitrum and Optimism. Both $ARB and $OP are trading significantly lower than earlier this year, and if history repeats itself, they could both see a rally leading up to this event.

Check out the Twitter thread I made breaking down Proto-Danksharding here:

https://twitter.com/ThorHartvigsen/status/1651222915822632961

3️⃣ Liquid Staking & LSDfi

As mentioned earlier, ETH liquid staking has seen the largest growth in Q2 of all the various DeFi sectors. Some protocols worth monitoring in Q3:

frxETH - Frax is launching frxETH V2 and the Frax chain later this year which amongst other things creates a native lending market for the LSD, increases the staking APY by having having frxETH as the native gas token on the chain and more. More on this later.

EigenLayer - Eigenlayer has seen large interest from investors already and as they launch properly later this year, it’s likely they experience a large inflow of liquidity.

swETH - Swell is doing a campaign where early minters of their native LSD swETH earn ‘pearls‘ which translate to the native $SWELL token airdrop. As long as this campaign is running, it’s likely the protocol continues to grow.

ETHx - Stader labs is launching ETHx on mainnet july 10th. The main feature will be the ability to run an Ethereum node with just 4 $ETH.

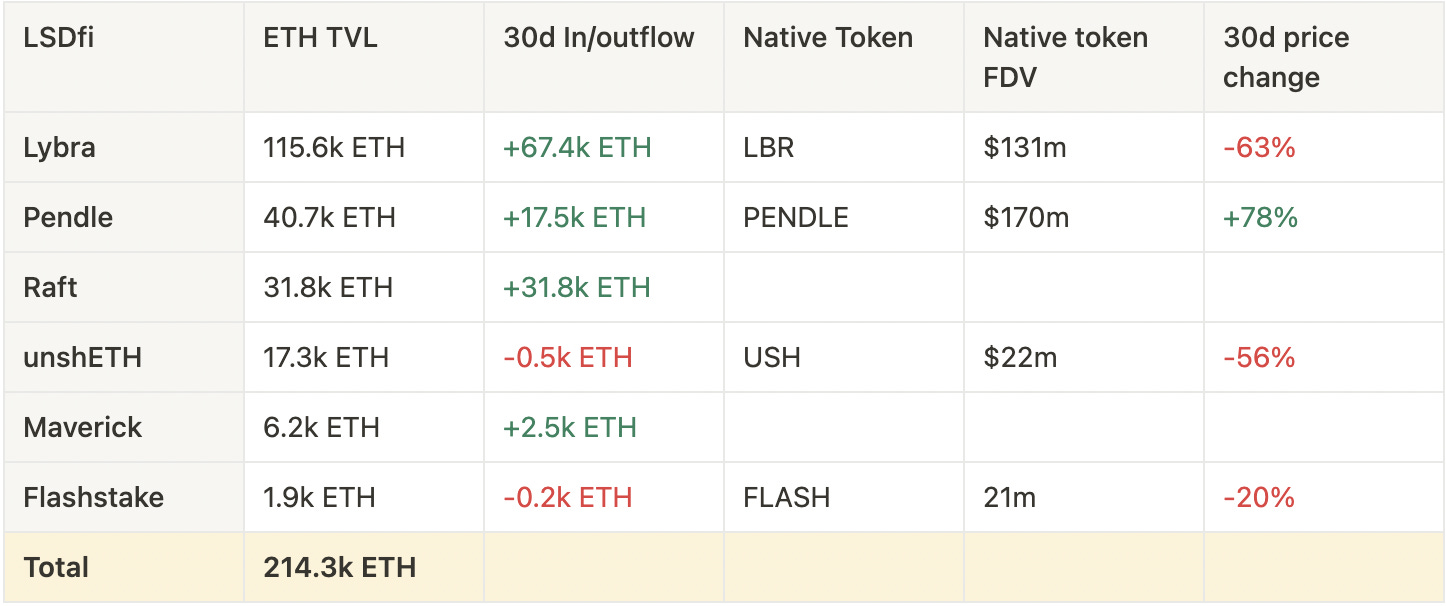

The major growth that the LSD sector experienced in Q2 is unlikely to continue at the same pace in Q3. A combination of a higher staking rate and less on-chain activity has caused the APYs to decrease across the board. With lower yields, stakers are looking for ways to increase their return, and that's where LSDfi protocols come into the picture. The table below is from last week's newsletter and portrays current stats for the top LSDfi projects📊

Pendle has experienced large growth in liquidity, and the native $PENDLE token has rallied over 100% in the past week, with the recent peak coming after the announcement of the Binance listing. The Pendle team likes to be discreet regarding new features on the protocol; however, I think it's safe to assume that there are many things in store for the protocol in Q3. They recently applied for an OP-grant to bootstrap liquidity on Optimism and hinted at a launch on the BNB chain. A cross-chain expansion seems to be close.👀

LSD-backed stablecoin protocols like Lyra and Raft have also seen significant growth recently. It's clear that there is demand for this type of product, but it's further evident that a significant part of the recent success can be attributed to large token incentives/airdrop farming. As of now, there are already 3+ protocols working on launching quite identical products in the upcoming weeks/months, so the competition for liquidity is without a doubt going to increase.

Chain Season⛓

4️⃣ Base (L2 by Coinbase)

Just last week, Coinbase announced that Base passed all the security audits and now fulfills 4/5 of the criteria for mainnet launch. Base is built with the OP-stack, and the recent launch of Optimism's Bedrock upgrade makes transaction costs on both Optimism and OP-chains like Base significantly cheaper. All that's left is 'testnet stability,' so a mainnet launch is likely to occur in Q3. Coinbase has over 40m registered users, many of whom have likely never dipped their toes in DeFi. This is likely one of the most significant onboarding events this year. Coinbase is likely only going to offer exposure to large battle-tested protocols like Uniswap, Aave, etc., but having a large retail base is great for the space.

Furthermore, this is likely a decent narrative for $OP as Base will commit a portion of transaction fee revenue to the Optimism treasury.

5️⃣ Frax Chain

Frax Finance has become a jack of all trades with products such as the $FRAX stablecoin, the $FPI price index, Fraxswap, FraxEther, FraxFerry (bridge), and more. Frax has now additionally announced that they're building a layer-2 blockchain on top of Ethereum, which aims to unite all of these products into one DeFi hub. It's a hybrid rollup, meaning that it is built with the optimistic rollup architecture while also utilizing zero-knowledge proofs for state consensus. The purpose is to ensure high scalability, fast finality, and strong security for the end-user. The chain is scheduled for Q3/Q4 this year, but the most significant part of the announcement was that frxETH will be the token used for transaction fees. This could, on one hand, increase the frxETH supply significantly if demand picks up for the new L2. Without getting too technical, more frxETH used for gas will also result in less of it being staked as sfrxETH, which causes the staking yield to rise. On the other hand, however, having to swap to another token in order to use the chain could be considered a burden to some users and, in the worst case, slow down adoption. I'm slightly skeptical but overall excited to see how this plays out.

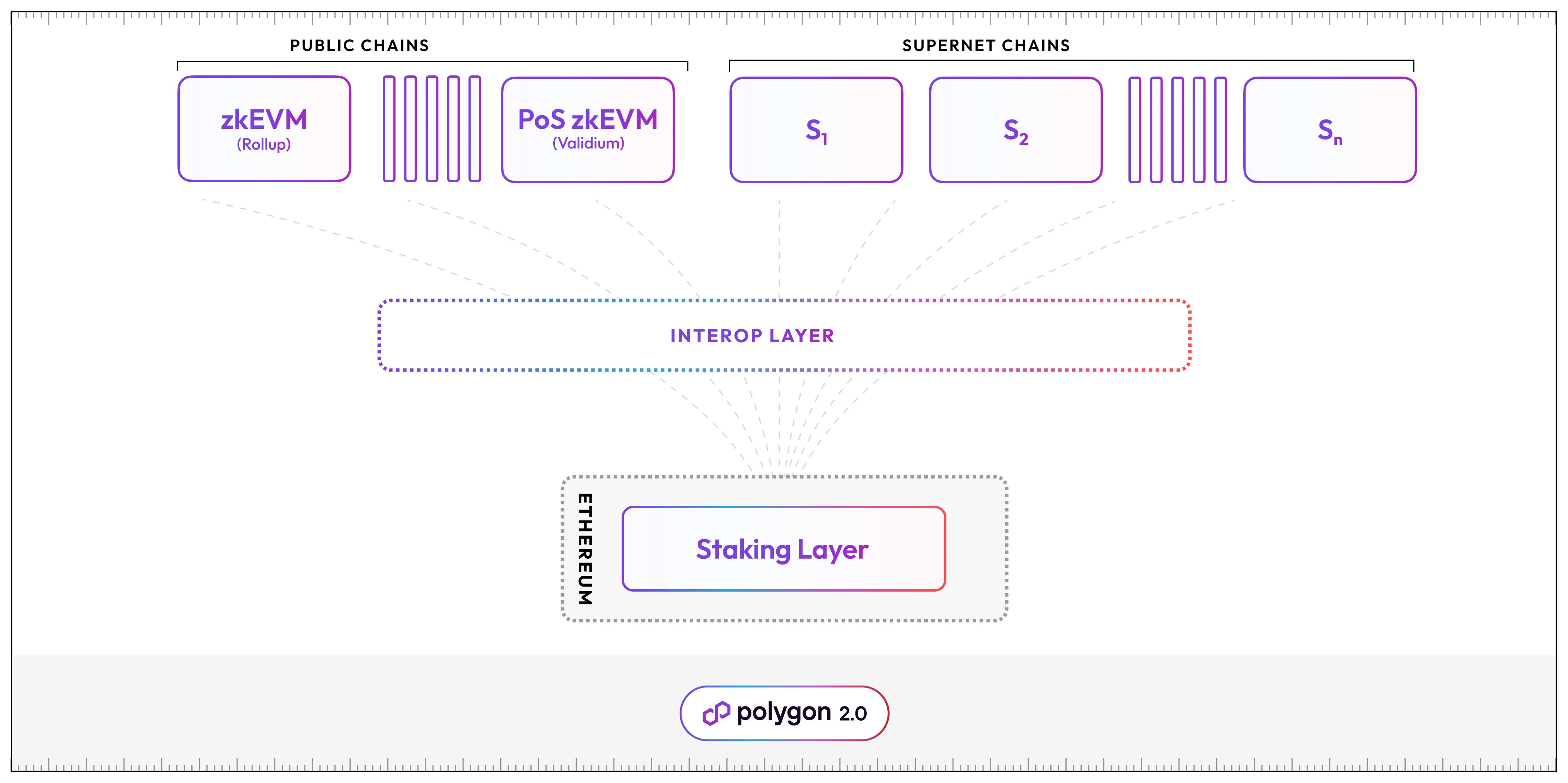

6️⃣ Polygon 2.0

Polygon recently announced ‘Polygon 2.0‘ which ties together all of the different innovations built by the team over the past years. It’s a combination of optimistic rollups like Arbitrum and Optimism but also incorporates mechanisms similar to interchain security from Cosmos. Polygon 2.0 consists of four layers.

Staking layer: Validators stake MATIC in a similar fashion as the PoS chain today.

Interop layer: Shared bridge that allows chains to mint assets to and from Ethereum in an interoperable way.

Execution layer: Polygon 2.0 will operate with two different sets of execution layers.

Supernets: Application specific blockchains similar to Avalanche’s subnets or the app-chains on Cosmos.

Public chains: The zkEVM will use Ethereum for data availability and will be the most secure but also the most expensive rollup. The proof of stake zkEVM uses Polygon for data availability (secured by MATIC) and simply just post the proofs on Ethereum for more scalability.

$MATIC has been experiencing a decline lately due to the forced selling resulting from Celsius off-loading their assets to buy BTC and ETH. The price might therefore bounce back once Polygon 2.0 gets closer to launching in the second half of the year.

7️⃣ dYdX V4

V4 aims to make dYdX decentralized by launching the exchange on a custom app-chain in the Cosmos ecosystem. The orderbook, previously operated in a centralized off-chain manner, will now be managed by validators on the app-chain through an in-memory orderbook. Trades will be committed by validators in each block to ensure that all transactions go through and that they have the same version of the orderbook/chain. Current testing has achieved over 500 transactions per second. $DYDX has faced criticism in the past due to high inflation and low token utility. With V4, it's likely that the token will gain a more significant purpose and potentially include aspects of revenue-sharing. The protocol mentioned this in a previous article.

“Beginning with dYdX V4, dYdX Trading Inc. will not operate any part of the protocol. As a result, it will no longer receive revenue based on trading fees from the protocol. The same is true for all other centralized parties, unless the community decides otherwise.“

The $DYDX unlock schedule is as follows:

- 30% December 1st 2023

- 40% in equal monthly installments on the first day of each month from January 1st 2024 to June 1st 2024

- 20% in equal monthly installments on the first day of each month from July 1st 2024 to June 1st 2025

- 10% in equal monthly installments on the first day of each month from July 1st 2025 to June 1st 2026

The public testnet is launching tomorrow which indicates that a mainnet launch is getting close. If there is an announcement regarding a $DYDX fee-sharing mechanism, this could act as a strong narrative for the token. It’s important to keep the large unlocks in mind however which starts in December this year.

Perp DEX catalysts

Besides dYdX, there are a lot of innovation happening in this corner of the space.

8️⃣ GMX V2

GMX V2 seems closer than ever as the public testnet went live a few weeks ago. This upgrade brings many new features, one of them being the adoption of Chainlink custom low-latency price oracles for better trade execution. Another big change is separate liquidity for each pair and the possibility to create synthetic trading pairs.

Each pair will have its own liquidity pool, i.e., ETH/USDC will have ETH as the long collateral and USDC as the short collateral. A synthetic pair could also be SOL/USDC, with a pool consisting of ETH as the long collateral and USDC as the short. This model intends to make it easier to deploy new pools, and the main benefit of isolated liquidity is less risk for the liquidity provider.

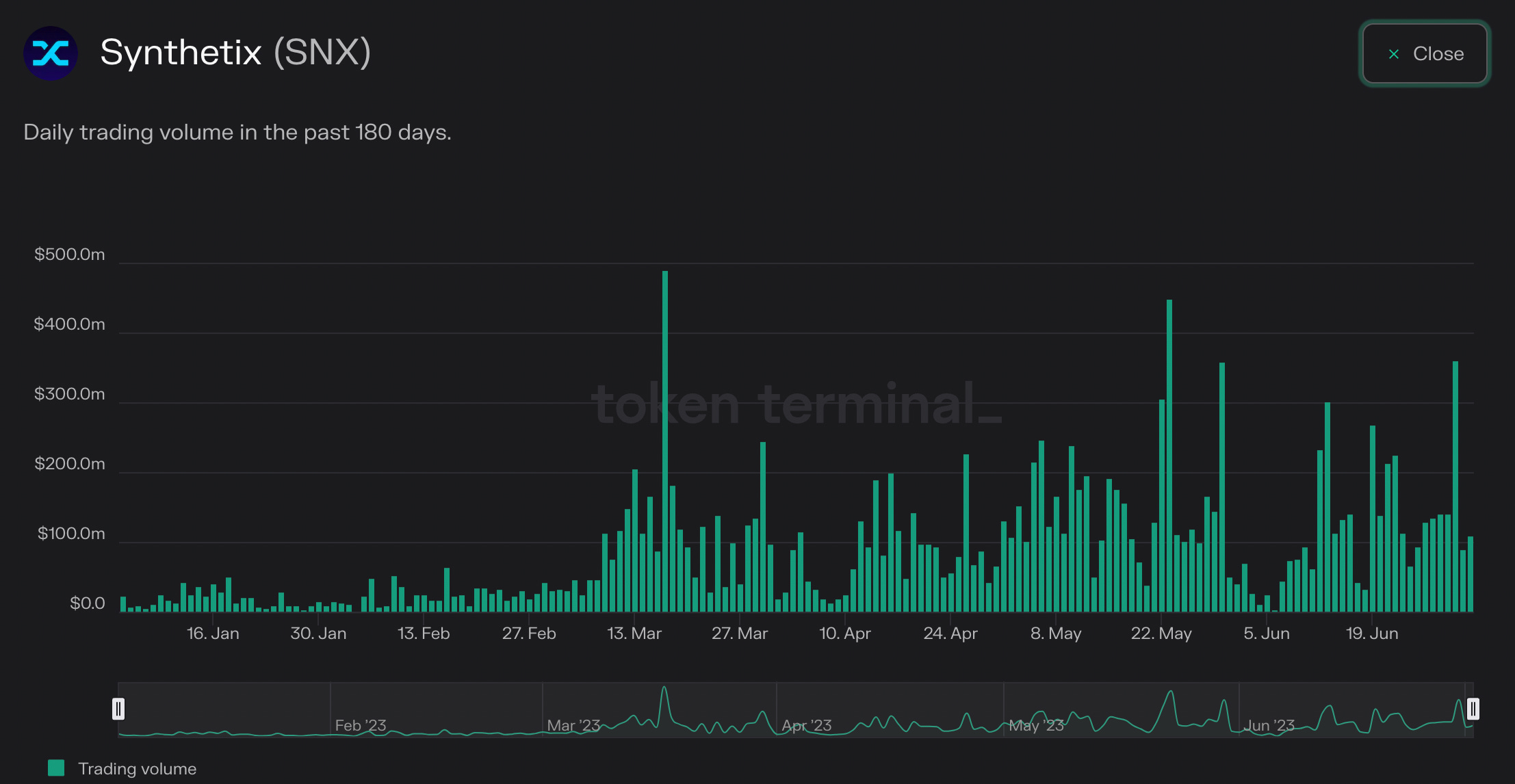

9️⃣ Synthetix V3

Synthetix is a DeFi liquidity hub and powers a variety of derivatives protocols on Optimism such as Kwenta, Lyra, Thales, Polynomial and more. Trading volume is up significantly this year with the majority of volume coming from traders on Kwenta.

Synthetix V3 is an upgrade that's been worked on for the past two years and aims to make the protocol the liquidity layer for all of DeFi. Currently, all synthetic assets are collateralized by the native governance token $SNX. V3 will introduce a variety of upgrades, including multi-collateral staking, permissionless pools with isolated risk, cross-chain liquidity, and more. V3 is technically already on mainnet, but the core innovations like Perps V3, Pools V3, Teleporters, and Cross-chain Synthesis are all under development.

Read all about the full vision and the roadmap here.

Others

Some other protocols that might be worth paying attention to in this sector.

- Vertex protocol launched recently and has seen a strong growth in trading volume

- Level recently launched on Arbitrum and ~50% of volume now comes from this chain

- Pear protocol is launching soon and will leverage current infrastructure as liquidity for their trading platform

That’s all for today! If you enjoyed the research please consider liking/ commenting/subscribing🫡

Please be aware that nothing stated is financial advice.

Thanks for reading DeFi Frameworks! I have a ton of interesting content planned so make sure to subscribe below⚡️