50+ Events/Catalysts Happening In May

EigenLayer airdrop, token unlocks, DeFi catalysts. So much going, how to keep up?

At On Chain Times, we’re launching a periodic newsletter covering significant catalysts and events in the Web3 space to help you stay ahead of the curve.

Here’s an overview of catalysts to keep your eye on in May 2024 across sectors from DeFi, NFTs, infrastructure, macro, governance, token unlocks, etc.

If you find the content valuable, let us know in the comments and leave a like.

Want access to more free research reports? Subscribe below and join 10,400+ weekly readers 🗂

🗂 Events/Catalysts List

⛓️ L1/L2s

- Blast L2 airdrop likely, Blur launching on Blast

- Worldcoin L2 to launch in summer 2024

- Optimism retro funding round 4 allocating 10M OP, sign ups begin on May 23

- Arbitrum LTIP (long-term incentive program) incentives begin distribution

- May 1st: ZKFair leveraging Polygon CDK, following the Elderberry upgrade last month. Source

- zkSync rumoured to launch their token soon

- Electra Protocol, a PoS L1 to launch mainnet May 1

- Bitcoin Cash network upgrade May 15

- XEC network upgrade May 15

- TON blockchain ongoing grants of 300K (user incentives) and 200K (team grants)

- Ripple (XRP) goes interchain to 60+ chains with Axelar Network integration

- BounceBit, a PoS L1 chain (for BTC restaking protocols) to launch mainnet

- QTUM PoS L1 to announce a new development roadmap

- Potential airdrop from Berachain

- Potential airdrop of Mode L2 chain

🪙 DeFi

- EigenLayer to airdrop 5% of allocation to stakers, claimable on May 10

- Renzo protocol airdrop, claimable April 30

- Drift Protocol airdrop likely in May

- Swell L2 launch and points airdrop

- Lido x SSV second testnet to commence in late May

- Maverick V2: AI programmable functionalities, ve dynamics and more

- Stride, a Cosmos-based L1 LST appchain ongoing airdrop programs to incentive DYM and SAGA staking

🌉 Bridges

- Stargate V2 introducing txn batching and dynamic credit allocation

- Curio Governance launch of XCM bridges on May 1

- Potential airdrop from DeBridge

- Potential airdrop from LayerZero

🤖 Crypto x AI/DePIN

- Ionet token launch (Apr 28)

- Nim Network, an AI gaming “rollapp” chain powered by Dymension to launch mainnet May 1

- NVIDIA earnings report (May 22)

- May 9th: World Mobile taken will take a staking snapshot

- Zero1 Labs set to announce its second project under the ZCP

- ScPrime is planning to migrate to the Solana blockchain

- May 1: Theta Network to launch EdgeCloud, a hybrid cloud computing platform

- May 14: Google/s I/O event 2024

- Possible GPT-5 release

🎮 GameFi/SocialFi

- May 15: Immutable X game Guild of Guardians mobile launch on iOS and Android

- May 17: Heroes Chained releases Fortunes of Ventuna on Android mobile

- May 22-24: Decentraland Community Summit in Argentina

- Friendtech V2 launch and potential airdrop

- Potential airdrop from Farcaster

🏴 Significant Token Unlocks:

- May 1: DYDX unlocks ~7% of float through May for investors and community

- May 2: SUI unlocks 16% of float (265M) through May, significant investor unlock begins May 31

- May 12: APT unlocks 2.65% of float (111M), mainly going to early contributors and investors.

- May 15: AEVO unlocks 718% of float; 21% of total May unlocks (185M) goes to investors

- May 15: STRK unlocks ~93% of float throughout May, mainly for foundation and community grants

- May 20: PYTH unlocks of 141% of float (1.38B)

🏦 Macro

May 1: Fed meeting for rate cuts. Markets are pricing in a 4% chance of cuts in May

May 3: Unemployment rate

May 14: PPI data

Any unemployment print greater than 4% might signal a major risk-off signal for markets, indicating weakness in labor markets

Initial claims above 300k tend to signal a recession is close

If initial claims remain around 200k and unemployment stays below 4%, the economy might remain in a goldilocks state, potentially leading to further price rises

May 15: CPI release; Inflation has been slightly higher than expected in recent prints, with rising oil prices acting as a tailwind for higher inflation.

May 23: PMI data

💰 Fundraises in April 2024:

Movement Labs Series A 38M raise, led by Polychain Capital

Berachain raises $42M Series A at valuation of 421M

DePIN project SendingNetwork raises 7.5M in seed round

Azuro, infrastructure for predictions and games raised 11M

📌 Highlights

$EIGEN Launch

Yesterday, EigenLayer announced the launch and initial distribution of the $EIGEN token. A total of 15% of the total token supply has been set aside for airdrops to EigenLayer stakers in which one third (5%) is distributed in the first season. The announcement was met with a lot of confusion from the community due to the vague description of the initial distribution. In short, it looks as following:

If you, like me, bought a Pendle YT-token after March 15th, you will be eligible for season 2 of the the airdrop.

Furthermore, from the EigenLayer docs, it appears that the token will be non-transferable for a few months and potentially not liquid/sellable until after all 15% of the supply has been airdropped (see image below).

Coinbase Q1 earnings report

Coinbase is set to release its Q1 2024 financial earnings on May 2 2024. With the bull market back in swing and trading volumes through the roof, analysts are expecting earnings and revenue to be the highest it has been since 2021. In Q4 2023, Coinbase hit profitibality of 273M for first time since the 2022 bear, after its stock rallied 555% to 218.16 today from its bottoms of 33.26 in Jan 2023.

US ETH ETF Deadline

All eyes are on the potential regulatory approvals of the ETH ETF in the US. May 23 is the deadline for approval, with PolyMarket currently pricing in a 12% chance of approval. An approval would open the doors of institutional capital to ETH. A rejection on the other hand, would likely lead to prolonged legal battles as the industry previously saw when Grayscale took the SEC to court in August 2023 over its rejection of the BTC ETF.

Meanwhile in Asia, three Bitcoin ETFs and three Ethereum ETFs launched on the Hong Kong Exchanges and Clearing Ltd. (HKEX) today, hitting over 6.3M in trading volumes so far.

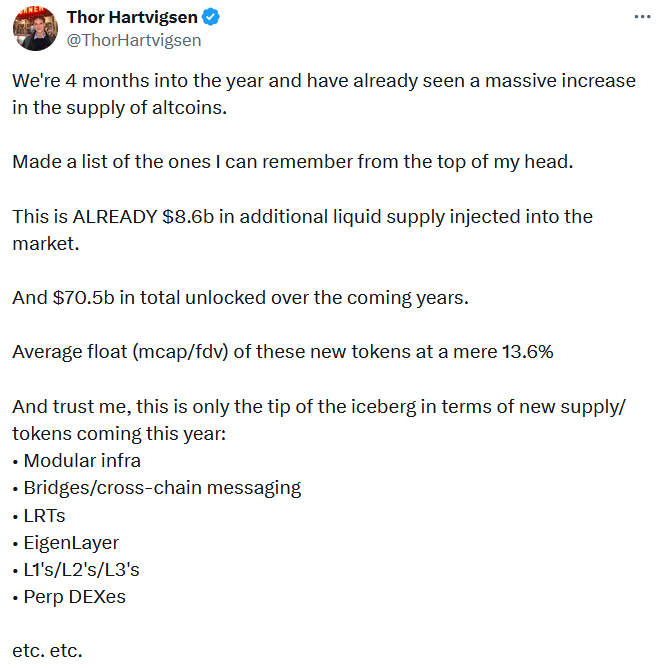

Altcoin Supply Tsunami

There is a bleak outlook in the altcoin market as many investors on CT are catching on to a massive increase in altcoin supply, with already 8.6B supply injected into the market just four months into 2024. A large amount of this supply is coming from the end of cliffs for 2023 altcoins. Total inflows into crypto are not offsetting this massive altcoin supply coming onto the market.

🎯 Notable DeFi Strategies

Ethena Season 2

Perhaps the most complex airdrop farms of 2024 is Ethena’s ongoing Season 2. These strategies range from low risk (holding USDe) to medium risk (buying Pendle’s USDe YT) to high risk (buying Pendle USDe YT and ENA). Want a step-by-step breakdown of these strategies? We got you covered in our guide to farming Ethena Season 2:

A Comprehensive Guide to Ethena S2

Thor, Donovan Choy • Apr 25, 2024

Ethena’s Season 1 ran for six weeks and the best farmers like Defi_Maestro booked profits as high as 8-figures. We conducted a deep-dive interview with Defi_Maestro on that winning trade. If you haven’t checked it out yet, you can do so here: If you missed out on Season 1, the good news is you’re not too late for Season 2. Pools are filling up quickly, b…

Read full story →

EigenLayer and LRT Season 2

As mentioned above, the EigenLayer S2 has been underway since the first snapshot (March 15th). While most of the LRTs are concluding their first airdrop, several have already begun/announced their S2 campaigns. We covered the Renzo S1 YT strategy roughly a month ago. The REZ airdrop today has itself covered the cost of this strategy, meaning that the EIGEN airdrop is purely additional profit.

Next week, we will cover EigenLayer S2, Etherfi, Renzo, Kelp and more. Make sure to subscribe if you haven’t already to ensure you don’t miss this.

Want access to more free research reports? Subscribe below and join 10,400+ weekly readers 🗂

Disclaimer: The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.