5 High ROI Points/Airdrop Strategies In April

Time is running out - catch these while you still can.

Introduction

The recent market movements, with Bitcoin setting a new all time high at nearly $74,000, have presented some mind-blowing DeFi strategies that, based on my assumptions and calculations, could net a 100-300% return within the next few months. How is this possible? Because with the return of the bull market, a few things are happening;

- New tokens launch at absurdly high valuations making airdrop farming increasingly lucrative

- Bull markets make traders more hungry for leverage and less sensitive to increased borrowing rates → pushing up DeFi yields

After doing some spreadsheet analysis last week, I identified a few strategies that blew my mind and made me deposit a good chunk of ETH into these. These include LRTs, the EigenLayer airdrop and several more.

Times Is Running Out ⌛️

But time is running out. The Ethena shard campaign concludes April 1st, EigenLayer is set to launch on mainnet in the coming weeks (potentially with its token as well?) and a few others are ending over the summer. Hence, there is little time left for several of these and if you are looking to get last minute exposure, this is your guide.

Thanks for reading On Chain Times. Subscribe to receive a free research report every week 🗞

Liquid Restaking Frenzy

At this stage, you’ve most likely heard all about EigenLayer, restaking, liquid restaking and the various protocols offering this service. I first deposited into EigenLayer to start farming points in Q3 last year as I anticipated the $EIGEN token could launch at a massive valuation. I predicted a $20b valuation which at the time was met with a lot of criticism, claiming that I was overly bullish.

Today, with nearly $11b deposited into EigenLayer and 30+ large applications already committed to being secured by restaking, a $20b $EIGEN valuation is deemed to be conservative and some are calling for $40-$50b FDV.

On top of this, EtherFi, the largest restaking protocol with >$2b in TVL recently launched its token $ETHFI which trades at around $4b. As you are able to farm both restaking airdrops and the EigenLayer airdrop simultaneously, it’s apparent that, despite the large amount of people farming these airdrops, this is still a great strategy from a return perspective. Below is a list of the current liquid restaking protocols that earn you both native points and EigenLayer points:

- EtherFi

- Renzo

- Puffer

- Kelp

- EigenPie

- Swell

There are additional protocols of smaller size. As the TVL lowers however so does the expected token valuation at launch which makes farming those airdrops less interesting. So let’s focus on the ones above. EtherFi already airdropped 6.6% of the token supply and will airdrop more in their season 2 campaign. The rest of the projects have yet to launch their tokens. Before diving into the best strategies, let’s look at the current state of the points and the corresponding airdrops.

Estimating Airdrop Returns

Etherfi

Etherfi is somewhat tricky to estimate as they already airdropped part of their supply and released their token. The team however just announced season 2 of their airdrop campaign. Some info:

- March 15th to June 30th

- Staking for a longer time earns more rewards

- 5% of the supply ($200m at current price) will be airdropped

Etherfi has introduced a system called ‘StakeRank‘ with 8 levels - by staking for longer, you rank up and earn a loyalty points rate boost. New ETH deposited earn points 10x faster than old ETH to make it fair to new users. Finally, in order to become eligible for the season 2 airdrop, >70% of points need to be accumulated during season 2. read more.

With roughly $3b farming $200m in rewards, you are effectively earning $0.067 per $1 deposited. As season 1 points also get a share, $0.05 is likely more accurate. A 5% return in roughly 4 months is equal to a 15% APY. While its not bad, there are definitely better places to park your ETH (or farm via Pendle but more on that later). In my opinion, if you don’t have any points from season 1, you are likely to get somewhat diluted even with the tweaks they’ve made.

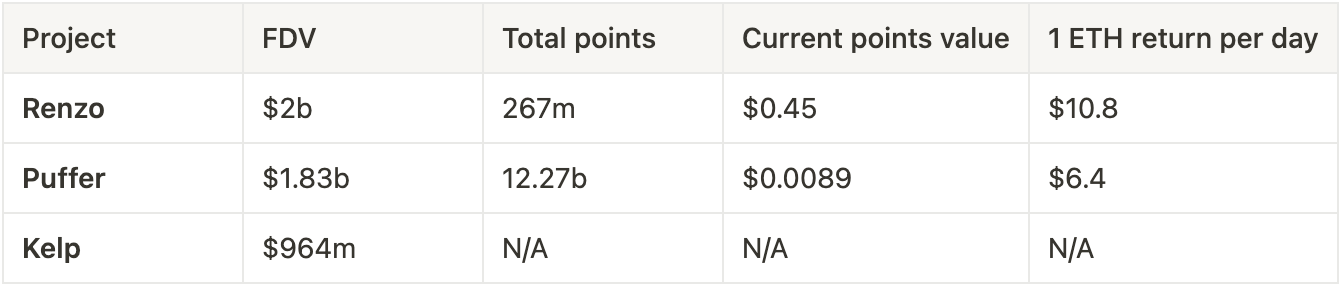

Renzo and Puffer

Renzo and Puffer are the second and third largest LRT issuers at respectively $1.4b and $1.25b in TVL. As the total supply of points is known, which is not the case for Kelp, Swell or Eigenpie, we can with a few assumptions create a valuation model for these. The FDV estimation is based on the valuation Etherfi is trading at relative to its TVL (roughly 1.5x FDV relative to TVL). Multiplying current TVL by 1.5x lands the Renzo token at a $2b FDV and the Puffer token at a $1.83b FDV. With both of these growing quite fast however, I would not be surprised to see both of these launch at $3b+ FDV.

Anyways, given the current number of total points and the estimated FDV, the current Renzo points value is $0.45 and $0.0089 for Puffer. Given 1 ETH earns 24 Renzo points or 720 Puffer points it seems that Renzo is the best place to park your ETH at the moment. Remember that you are also earning $EIGEN points on top of this, which are valued at $0.2 per point at the moment. Finally, keep in mind that these values drop over time as more points are emitted to depositors.

Swell, Kelp and Eigenpie

Neither of these three have enough available information for a detailed estimation. Of the three, I’m most bullish on Swell as they are launching their own L2 and further have their own LST called swETH in addition to their LRT. All in all, I believe that, out of all the liquid restaking protocols right now, Renzo is the place to be.

Links to use the respective protocols:

Keep in mind that simply just depositing into a liquid restaking protocol is not enough if you want to maximize your airdrop. There are several ways to get leverage exposure to these points so let’s dive further into this.

Leveraged Airdrop Farming

This is where it gets fun. After doing some calculations last week, I had to confer with a few DeFi experts to make sure my math was correct. After ensuring this, I aped into the strategy as this might be best risk adjusted return for ETH at the moment. Before diving into this, please consider subscribing to On Chain Times if you haven’t already in order to show your support and stay tuned for more strategies like these in the future.

Renzo & Pendle’s YT-ezETH

We have established that Renzo likely is the best place to park your ETH for maximizing your LRT airdrop return. On top of simply holding Renzo’s LRT, ezETH, which earns 24 points per day per ETH deposited, you can get leveraged exposure via Pendle. The intricate mechanics of Pendle can be fairly complicated to grasp and require a standalone report but what you should now is that in relation to LRT’s, Pendle can offer either:

- Leveraged points & yield (YT-ezETH)

- Fixed yield but giving up your points (PT-ezETH)

As seen below, you can give up the ability to earn points but earn 63.29% fixed yield on ezETH for the next 31 days (until maturation April 25th). Alternatively you can get 24x leveraged exposure to the yield and points. Since Renzo offers 2x points on Pendle, i.e. 48 points per day per ETH, the Renzo points leverage is 49x and the EigenLayer leverage is 24x.

So how does this work? For 1 ETH or ezETH you can purchase 24 YT-ezETH which all earn points. Here’s a reference:

- Holding 1 ezETH accumulates 24 Renzo points and 24 EigenLayer points per day

- Swapping 1 ezETH into 24 YT-ezETH and holding accumulates 1152 Renzo points and 576 EigenLayer points per day

Pretty significant difference and seems almost too good to be true. So what’s the catch? Well the YT-ezETH tokens are worth 0 at the date of maturity. The price depends on Pendle market forces but will gradually decrease over time. You are therefore betting that the yield/airdrop you are receiving will be worth significantly more than what you spent on buying the YT tokens. You can of course sell a day or two before maturity, but as there will be little buyers at this point the YT price will have decreased significantly. A general rule; the closer to maturation you hold your YT tokens without selling, the less they will be worth. Let’s crunch some numbers to see if it’s still worth it (tl;dr: It is).

Estimating The Airdrop Return

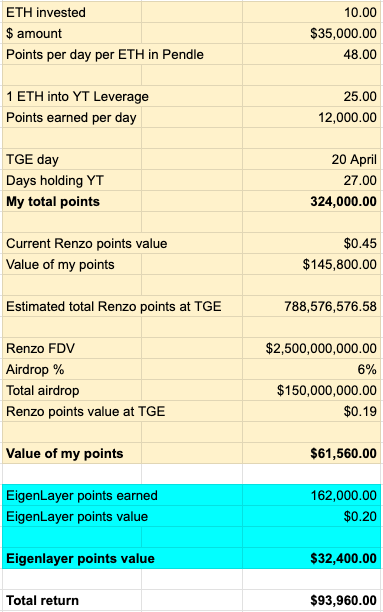

Below are the calculations of depositing 10 ETH into YT-ezETH on Pendle (shoutout to Pendle Intern for bringing this to my attention).

A deposit of 10 ETH (~$35,000) nets a return of $93,960 in 27 days if you don’t sell any of the YT-ezETH tokens before they go to 0. Realistically (if you sell a few days before) this could be above $100k which is almost a 3x in less than a month. Earlier, we estimated that the current value of a Renzo point is $0.45. With the large growth in TVL, my model estimates that the points supply will grow quite substantially and the value of Renzo points likely will end at around $0.19 as a more realistic target.

In 27 days, you earn 324,000 Renzo points worth $61,560 at $0.19 per point and 162,000 EigenLayer points worth $32,400 at $0.2 per point. Keep in mind that there are a lot of assumptions here and if the points programs go on for longer than expected, the returns could look different. If something regarding the math doesn’t make sense, feel free to DM on Twitter for additional questions. Also, keep in mind that there is shallow liquidity for this strategy at the moment due to high demand.

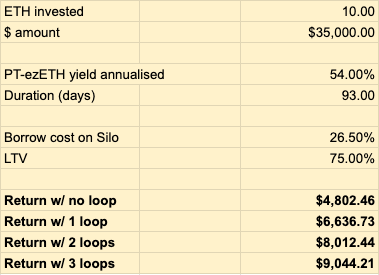

Fixed Yield Pendle Strategy

You can also take the other side of this trade by buying the PT-ezETH token which grants a fixed yield on the asset but makes you give up the yield and the ability to farm points. For lower gas fees, I’d suggest depositing into the Arbitrum PT-ezETH market which nets a fixed yield of 54% for the next 93 days. On top of this, you can loop this on Silo Finance where you deposit PT-ezETH, borrow ETH which costs 26.5% annually, convert that into more PT-ezETH and repeat. The math is displayed below but keep in mind that the borrow rate on Silo can be highly volatile. With PT tokens, you keep your initial deposit so the return you see below is on top of the $35k that you keep after the maturation of the market.

Another strategy worth looking into is the carry trade performed by Ethena Labs in which 50% of the liquidity is used to short ETH and farm the funding rate while hedging by holding staked ETH. You can do this yourself but instead of holding an LST, purchase PT-ezETH for the long side of the position for a much greater return. A detailed breakdown of this will follow in another report.

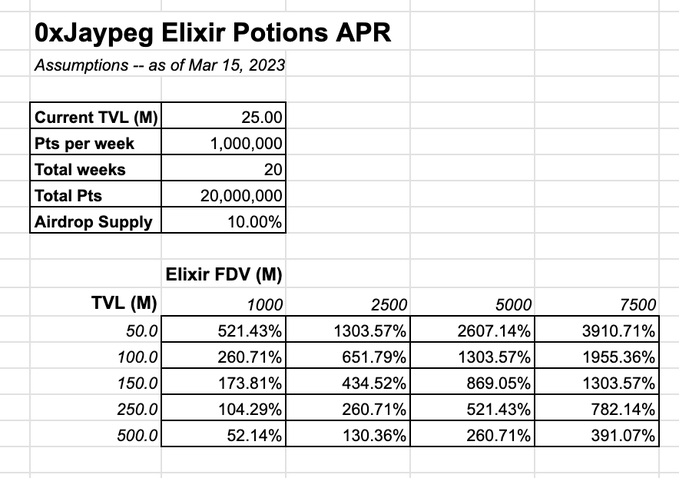

Elixir

Let’s now move on from EigenLayer and LRTs. Elixir is a dPOS network that lets users provide liquidity to orderbook exchanges through vaults and earn market making rewards from these. Elixir recently announced their Series B round at an $800m valuation and further just launched their airdrop campaign which is ongoing till August 15th when their mainnet launches. 0xjaypeg made a great sheet as shown below which estimates the APR earned from depositing ETH and minting ELXETH depending on the TVL and Elixir FDV at launch.

You can check out Elixir here.

Free Airdrop Farming?

Short on cash but have plenty of time on your hands? Some airdrop farms that don’t require locking up a significant amounts of liquidity:

- Grass.io (set up the browser extension and earn points)

- Hyperlane (swap back and forth between different chains)

- Jumper Exchange (swap back and forth between different chains)

- Berachain (interact with the testnet)

That was all the strategies for this issue - feel free to leave a like if this information was valuable. There will be many more strategies covered in future reports so make sure to subscribe to On Chain Times if you haven’t already.

Disclaimer: The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.